How to estimate market shares?

Added on 27/01/2022

If you estimate a market share and present this to the sales and marketing department, their input will show high variance. How can you reduce that variance and how can you achieve the best and realistic estimation of the market shares?

Let’s start with the hypothesis that your innovation will take a 60% market share. What does this percentage mean from your point of view? The estimation you provide will probably be correct. And posing this question to an audience familiar with marketing and sales will probably, again, elicit the correct answers. But comparing all the answers received will show a high variance. How do we reduce that variance, and how do we achieve the best possible estimation of market shares?

It’s extremely important that those needing to estimate market shares are aware of some of the relevant variables, and that all stakeholders understand how you have arrived at your view.

Several issues need to be resolved before providing market share estimations:

Time: Is the period concerned expressed in calendar years, or projected over launch years?

Market Share from what?: Are we referring to patients (incident or prevalent?), subgroups, sales units (DDD or packs), sales data (with or without rebates, tax, refunds etc.), full market (ATC level), indication-related or full label etc.?

Perspective: The information given to the government (payer) should align with the estimated ‘real-life’ sales distribution (towards the patient) and not necessarily with sales data (towards a warehouse or other business partner).

Methodology: Is the projected market share equivalent to and stable over one full year, or does the company instead target the objective by year-end? 60% at year-end is not necessarily equivalent to an average market share over 12 months. And do you take influencing elements into account (example: COVID-19 effect), competitors, patent loss, budget measures etc.?

Some team-related interpretations might pop up. The views of marketing may differ from market access. A marketing team might claim a higher (or lower) sales forecast, while market access needs to play devil’s advocate because the estimated annual budget to be paid by the government can influence the probability of market access success.

An important variable is the market uptake. The more quickly new patients benefit from your innovation, the more budget will be needed over time – certainly when chronic diseases are in scope. If an early access programme or medical need programme is implemented before reimbursement, it is likely to cause a faster onset once reimbursed.

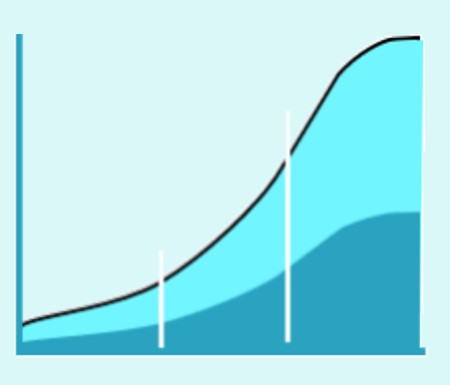

Some clients prefer to work with dynamic market shares. They shape the curve (% MS over time) in line with market behaviour (competitors) and clinical expectations (awareness and media-driven events) from clients and prescribers. Seasonal elements can also have a significant impact on the expected market shares. A familiar example is diagnostic tests for influenza. Sales figures are likely to demonstrate some peak sales over the winter months, while other disease characteristics may appear to be more pronounced during other periods of the year.

So when you are again asked about expected market share(s), don’t be too quick to answer. We are used to steering our clients towards value-based data. It’s in our DNA to challenge the data received versus the governmental perspective and the real unmet medical need in the relevant eligible population (potential market share). This will facilitate the procedural negotiations, alongside setting up a management entry agreement (if needed).

As consultants we motivate our clients to reduce complexity as far as possible. We recommend 1) using 12-month periods starting from launch; 2) implementing market shares over the selected periods; 3) estimating market shares at the level of the competitors versus your target population and in line with the scope of your reimbursement request; 4) taking the MNP effect and free goods into account; and 5) performing a scenario analysis.

We’ll be happy to provide you with further details on request.

Good luck,

Hebias