The value of a proven pricing structure

Added on 30/01/2024

How to prove the concerned price if the specialty is not yet produced? What is the value of a proven pricing structure if the price is downsized over time? Lets discuss to overcome this bottleneck.

If a pharmaceutical company targets to sell a pharmaceutical specialty in Belgium, the Minister of Economy must first approve a maximum price, after assessment by the price committee consisting of 15 members. The applicant must propose an ex-factory price for each registered packaging they wish to trade in Belgium. If a reimbursement procedure is initiated as well, the government will take the approved maximum price as the maximum list price for reimbursement. The resulting list price could therefore be lower than the maximum price approved by the Minister of Economy as notified to the reimbursement bodies (NIHDI).

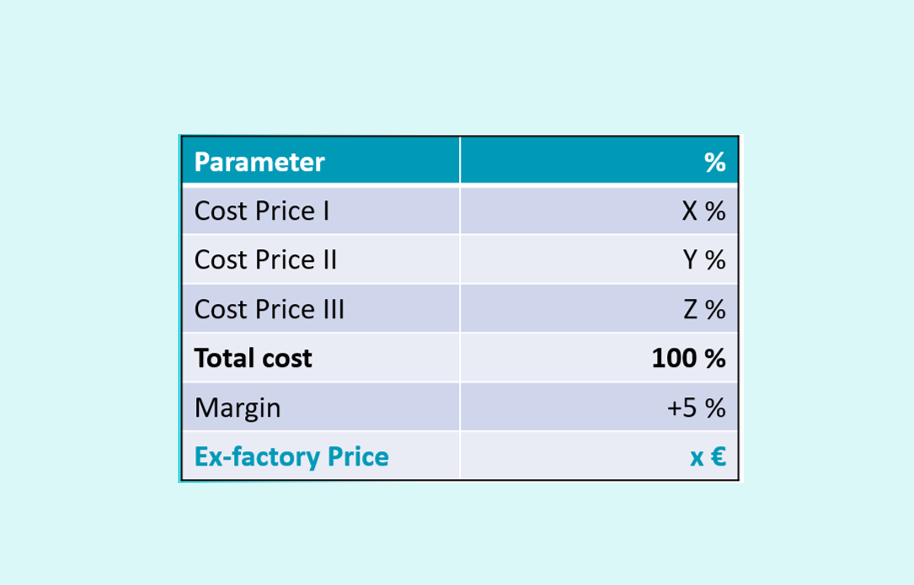

A price request (or request for a price increase) is a formal procedure supported by use of an official price structure as published in the State Gazette of July 1, 2014 (Appendix 1) in line with the Royal Decree of April 10, 2014. Several cost components are included in the price structure, of which the sum represents the requested ex-factory price. Once the maximum ex-factory price is approved by Economic Affairs, the (potential) price that will become reimbursed by the insurance bodies (basis of reimbursement) and/or patient (co-payment) can be calculated taking into account the official margins for the wholesaler and/or (hospital) pharmacy.

The pricing structure consists of 3 sub-costs: Cost price 1 (the costs that lead to the availability of the specialty (research and development / production and packaging / transport and transfer)); Cost price 2 (the costs related to the commercialization (wages / medical information / shipping costs and storage)); Cost price 3 (financial costs). In practice, one speaks of CP I, CP II and CP III, with the ratio between CP I and CP II being approximately 85%/15%. CP III is often set at 0% .

The aim of course is to generate a correct price structure of which the sum of the individual components should generate the actual price after which an acceptable profit margin is added. In practice, this margin can be 5% or lower.

In practice, however, it is very difficult to generate an acceptable price structure for several reasons:

- It is likely that the number of units has an impact on the average cost of the individual packaging. Question is how to estimate the number of packages if there is no official price yet, and without the knowledge of potential restrictions imposed (e.g. reimbursement criteria). The volume (bulk) effect is therefore a parameter which causes uncertainty to the claimed cost.

- Even if the price and reimbursement criteria would be known, it would still be a matter of guessing how prescribers will use the medicine.

- There are economic variables (inflation, availability of raw materials) as well as clinical variables that can have an impact on the final cost price.

- Additionally, for hospital specialties, which can be sold via tenders, strong commercial conditions also influences the cost.

- …

And what if the reimbursement procedure results in a lower list price and/or temporary reimbursement (linked to a volume contract between the government and the company)? What is the value of a proven price structure if the price is reduced in a later procedural phase? Does the company sell the specialty with financial loss (which is not legally permitted) or has the company bluffed about the real price?

In our opinion, it is virtually impossible to generate a correct price structure before the final market conditions are known. Then why provide evidence? Many companies have addressed questions to us and are eager to hear / learn? how other companies approach their pricing structures. In other words, there is a need for a simplified, legal and credible proposal.

But, the law is the law and a price structure must be built in line with the Royal Decree of April 10, 2014. Well, … how to start proposing a price and associated structure?

Most of our customers work ‘reciprocally’ and start from an (internal) preliminary study in which the economically justified price (EJP) is calculated. This international EJP often defines the potential target price, after which the individual countries develop a competitiveness analysis taking into account the price of the comparators, the price in the surrounding countries (reference countries), the clinical added value (medical need), etc. After several rounds of coordination regarding the feasibility of a price, a ‘floor price’ is determined for both the potential visible list price and the non-visible net price.

Based on these pricing targets, the business objectives (sales volume to be achieved) are defined, after which the company estimates the resources needed to achieve the commercial objectives. In other words, the target price is related to CP II but has relatively little impact on CP I.

To determine CP I, local companies often consult their headquarters to know the ‘approximate’ price. Of course, this is the bottleneck of the information needed as the production has to start in many cases.

If the company has been on the market for several years, the annual accounts of previous years can provide some insights. These annual accounts can help companies to provide insight into the expenses related to some cost components included in the price structures (wages, general costs, assets, etc.). Naturally, some components are not ‘covered’ by this information and the company must prove the costs with ‘official’ documents (e.g. production costs for other countries, cost for the set up of (additional) Belgian specific studies, …).

What we recommend to our customers:

- Perform the calculations in a logic way.

- Use existing pricing structures as a starting point.

- Use a uniform approach for all specialties throughout the entire portfolio.

- Rely on and use official documents as much as possible.

- Be transparent with Economic Affairs and contact the relevant services.

- Propose your pricing structure to pharma.be and/or Medaxes and discuss the structure in sufficient detail.

What we recommend to the competent authorities:

- Establish guidelines that take the above factors into account.

- Revise a pricing structure after obtaining a temporary and/or permanent refund.

An international price range could be established from a joint HTA, taking into account the clinical (added) value as recognized by the EMA. By doing this, the outcome of a joint HTA can potentially influence the country specific efforts needed, including the risk of parallel trade and the need to set up managed entry agreements or revisions. Let’s think, … together!